The closed world of investing

14th September 2016

How to claim your 'share' and open up the 'closed' world of investing.

The financial world can seem closed off and intimidating because of complex products and jargon, which threaten to stand in the way of the PM’s promised idea of ‘Shared Capitalism’. At Crowdstacker, we took the time to ask people what they really think about investing, and believe we have come up with some interesting ideas to simplify and open up the process.

Back in July we went to the country and asked people what they thought about investments, whether they felt it was an inclusive world and what needed to be done to ensure everyone has fair access.

What we found surprised even us.

Perhaps most worrying is that a fifth of British workers said they don’t know what an ISA is, and half claim they do not invest money because of financial jargon and confusing products.

So, despite Theresa May’s promise to focus on a more even distribution of the spoils of capitalism, a shocking lack of know-how amongst the average British adult could prove to be one of the biggest barriers to fulfilling this.

Findings from our study indicate that more than half (51%) of adults feel excluded from investing because of the technical jargon used and difficult to understand products, or not having the required confidence or knowledge.

Even some of the most common pieces of jargon used in the financial world were not always easily understood:

- Almost three quarters (78%) of adults do not know what a retail bond is

- More than half (59%) do not know what the FTSE is

- Nearly two-thirds (63%) could not define what a dividend is

- Nearly three quarters (73%) could not explain what standard terminology ‘AER’ stands for or means

The lack of knowledge could be worse amongst the younger generation with one in ten (10%) 18 to 24yr olds thinking that the Roald Dahl’s BFG word ‘Lixivate’ and Joey Essex’s made up ‘confrontate’ were real financial terms.

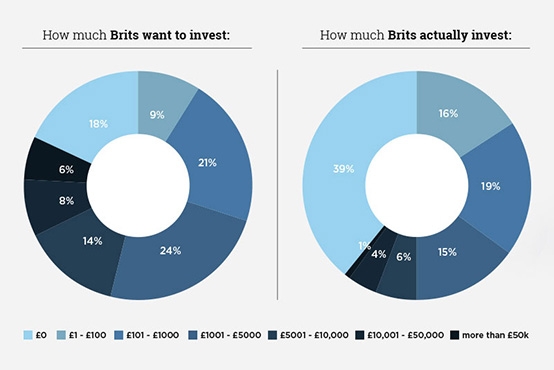

The impact of this on the average worker’s savings and the cost to potential investment in the British economy is likely huge. A quarter (24%) of British adults said they would like to invest an average £2500 of their annual spare cash to try and grow a bigger savings pot. This equates to a potential extra £31bn* annual cash injection to the economy.

“Our research reveals the world of investment remains largely closed off to all but a privileged few meaning only a certain section of the population is able to explore and utilise the range of investment options that exist beyond simple ISAs and pension schemes,” explains Karteek Patel, CEO of Crowdstacker.

“The complexity of how the financial world works is difficult to explain and understand, and it’s made worse with the use of jargon and abbreviations. But those of us operating in the Financial Technology (FinTech) arena have a wonderful opportunity to change this and spearhead new ways to involve more everyday investors by making investment more interesting and much easier to understand.”

Some of the most interesting findings from the study include:

- The FTSE is often used in the media as a barometer for the British economy, yet understanding of it is very low. Nearly three quarters (74%) of 18-24yr olds and more than two-thirds (70%) of 25-34yr olds could not correctly explain what it is

- Despite being one of the global financial capitals, over two thirds (70%) of Londoners could not correctly define what the FTSE is, and a third (34%) could explain what a dividend is

- Edinburgh was the only city in the whole of the UK where everyone questioned correctly defined what an ISA is

- Two-fifths of people were unable to say what a retail bond is, whilst over a quarter (27%) think it provides a guaranteed return

- A third of people (32%) prefer to stick to what they know by putting their cash in a savings vehicle such as a bank account – which currently offer relatively low returns (at low risk) whilst the base interest rate is just 0.5% - and nearly two-fifths (39%) of people make no investments each year

At Crowdstacker, we are striving to further affirm our commitment to assisting everyday investors in making the right financial decisions based on their personal circumstances in a number of ways, including seeking Plain English approval of investor materials.

“We did this research to find out how confident people are about investing so that we can accommodate this in how we choose and put together investment options. We are also reviewing our investor materials to ensure they are written clearly and simply so that our investment opportunities are easy to understand for everyone,” explains Karteek.

Crowdstacker is run by Mark Bristow and Karteek Patel, both of whom enjoyed City careers before setting up the platform.

“Our founding principle was to use P2P lending as a way to open up to the everyday investor some of the high quality business investment opportunities that are normally the preserve of the privileged few,” Karteek continues. “As one of the few platforms with full FCA authorisation we are already held to the highest standards of clarity and transparency for investors, but we want to go above and beyond this by offering simple and straight forward investment opportunities designed to benefit investors and businesses alike.”

The Crowdstacker Peer to Peer lending process is simple and easy to understand. Clck here to find out more.

All data used in this release has been compiled from research carried out amongst 2000 UK consumers by Mortar Research on behalf of Crowdstacker in July 2016.

* The latest Government Census (http://webarchive.nationalarchives.gov.uk/20160105160709/http://www.ons.gov.uk/ons/rel/pop-estimate/population-estimates-for-uk--england-and-wales--scotland-and-northern-ireland/mid-2014/sty---overview-of-the-uk-population.html) indicates that the UK population is 64.6m, of which 52.1m are over 18yrs.