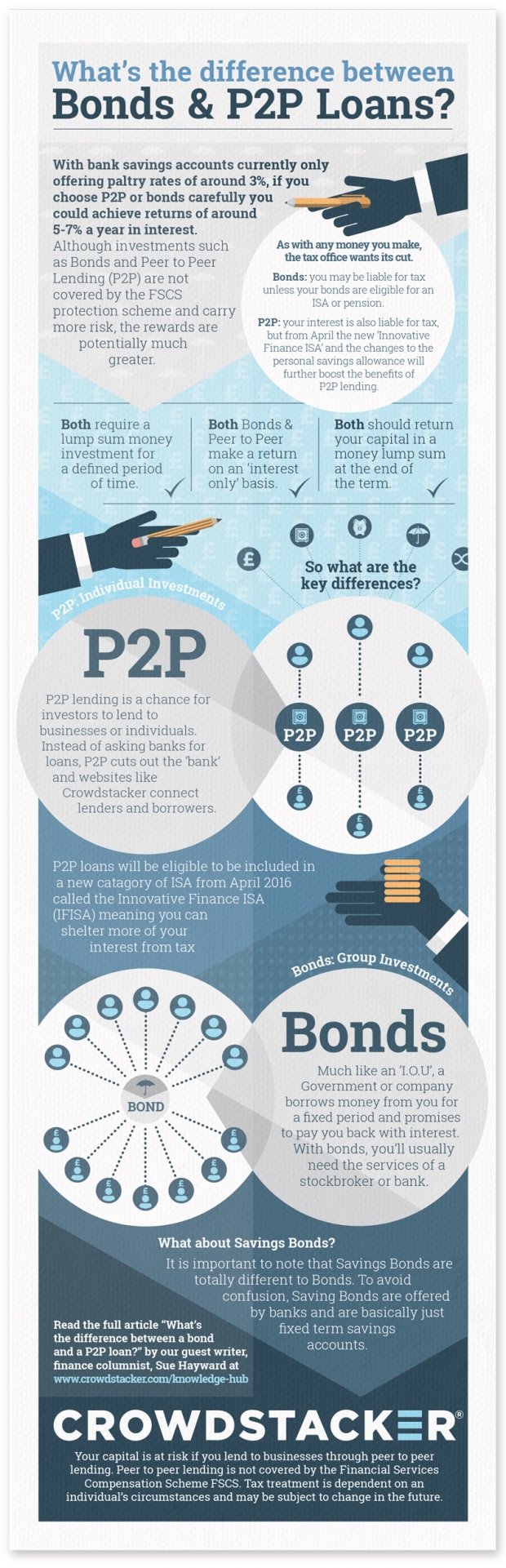

Bonds vs P2P loans infographic

15th February 2016

With bank savings accounts currently only offering paltry savings, with the best offering rates of around 3%, we believe that investing your money in bonds and peer to peer (P2P) loans could be an attractive alternative. Although investments such as bonds and peer to peer lending (P2P) are not covered by the FSCS protection scheme and carry more risk, if you choose P2P or bonds carefully you could achieve returns of around 5-7% a year in interest. Read the full article that accompanies this infographic by our guest writer, Personal Finance Columnist, Sue Hayward.