Out with the turkey and tree...

...in with thrift and good intentions

By our guest writer, personal finance journalist, Emma Lunn.

The Christmas splurge is now over, and whilst our waistlines may be a little bigger, our bank balances almost certainly aren’t.

In a fit of masochistic regret, we thought we’d take a look at just how much money consumers have spent over the last few weeks, and how much we could have saved if we’d been a little more restrained.

The facts and figures about how much Brits spend on “the holidays” are coming through thick and fast.

According to reports in the Guardian, UK shoppers spent more than £1bn online on Black Friday alone, with near enough the same amount being spent on Cyber Monday.(1)

Estimations about how much individuals spend on Christmas vary wildly: Travelodge says £615 each, flash sales website SecretSales.com £475, and Webloyalty £442. (2)

YouGov research suggests British households spent an average of £821 in 2014. This is made up of £604 on presents, £174 on food and drink, and £43 on cards, trees and decorations. (3)

But it doesn’t take research to tell us that we spend too much on Christmas. Every time you buy a fake plastic tree or sparkling Santa hat you know deep down it’s a waste of money. Do you really need those cuddly singing snowmen?

So should we, in fact, cancel Christmas and fast-forward to January when many of us are forced to save or invest money to make up for the Christmas splurge?

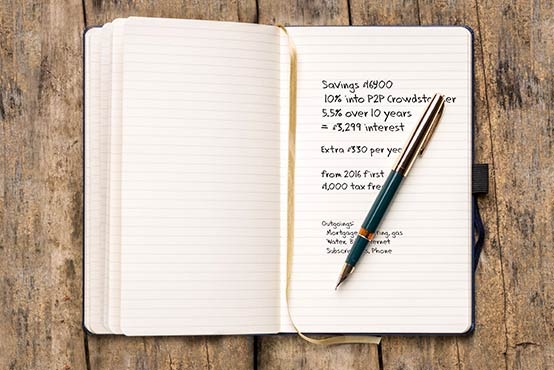

We’ve taken a look at how much interest £800 could generate if it was saved or invested instead of spent.

Interest rates on bank and building society savings accounts are currently very low. Natwest, for example, has recently cut the interest rate on its cash ISA from 0.5% to 0.25%.(4) Saving £800 in this account for a year would generate just £2 in interest.

Even the table topping high street rates aren’t much better. The best easy access savings account is currently from RCI Bank and pays 1.65% AER (Annual Equivalent Rate).(4) A lump sum of £800 would generate £13.20 in interest over a year.

Better interest rates are possible if you’re happy to tie your money up for a few years. One of the highest rates available is a five-year bond with Agri Bank paying 3.15%.(4)

So what if the £800 was invested instead of saved?

Much higher interest rates are available through peer-to-peer lenders such as Crowdstacker. Investors looking for a better return can lend their cash directly to businesses looking to borrow – cutting out the banks.

For example, you could invest the money in an investment like the one offered last year by Quanta Group on the Crowdstacker platform, for three years and could earn 6.8% per annum.

Alternatively, investing in Amicus Intelligent Lending offered an interest rate of 5.43% with a minimum investment term of 18 months. Lending £800 to Amicus could result in £43 interest a year or £66 over the 18-month minimum term.

Crowdstacker will be launching a series of similarly carefully curated and attractive investment opportunities throughout 2016.

All investments carry some degree of risk but peer-to-peer platform Crowdstacker only allows investors to lend money to credit checked and fully vetted businesses. Investors can diversify their investment by splitting their money between several businesses or borrowers.

With potential returns of up to 6.8% offered by marketplace lenders/peer to business platforms, isn’t that a better investment than those singing snowmen you bought last month?

For more information on the latest developments in the world of savings and investments in 2016 click here.

Your capital is at risk if you lend to businesses. Lending through Crowdstacker is not covered by the Financial Services Compensation Scheme. For more information please see our full risk warning https://crowdstacker.com/risk-warning.

Please note all accounts and rates of interest quoted are correct as of 10th December 2015.

- http://www.theguardian.com/money/2015/nov/30/cyber-monday-black-friday-o...

- https://www.travelodge.co.uk/press-centre/press-releases/UK-economy-set-..., http://www.telegraph.co.uk/topics/christmas/christmas-news/11982720/Chri..., https://webloyaltycorporatecontent.s3.amazonaws.com/webloyalty-christmas...

(3) https://yougov.co.uk/news/2015/12/01/british-households-expected-christm...

(4) figures taken from http://www.moneysupermarket.com/ on 10 December 2015?